Do you know what happens to most mortgage REITs when the Federal Reserve increases short-term interest rates? I'll give you a hint: It ain't good. But what if there was an 8% yielding mREIT that actually benefited from rising rates. Oh yeah, that's right, there's is, and it's calledStarwood Property Trust (NYSE: STWD ) .

Starwood Property is a specialty lender, so unlike other mREITs like Annaly Capital Management (NYSE: NLY ) that buy bonds made up of residential mortgages, Starwood Property makes loans to businesses for commercial properties. This uniqueness makes a huge difference when it comes to managing interest rates.

What happens when rates rise? According to the most recent projections from the Federal Open Market Committee -- a branch of the Federal Reserve -- we could see an increase in short-term interest rates as soon as themiddle of 2015.

Because mREITs borrow based on short-term rates -- like the Federal Reserve controlledfederal funds rate -- any increase will make borrowing more expensive and cut into their earnings.

The last time the Federal Reserve increase rates was in 2004. For Annaly, this jacked up their cost of funds and the company's dividend was cut in half. I don't say this to pick on Annaly, in fact, if similar mREITs like American Capital Agency or ARMOUR Residential REIT were public companies at the time it is likely their dividend would have met a similar fate.

The last time the Federal Reserve increase rates was in 2004. For Annaly, this jacked up their cost of funds and the company's dividend was cut in half. I don't say this to pick on Annaly, in fact, if similar mREITs like American Capital Agency or ARMOUR Residential REIT were public companies at the time it is likely their dividend would have met a similar fate.

Starwood Property is differentThis will not happen to Starwood Property. In fact, the opposite happens because, as of November 2014, 78% of its loan portfolio has a floating interest rate tied to short-term interest rates.

Sounds fancy, but all it means is that businesses borrowing from Starwood Property will pay a higher or lower interest rate on their loans depending on where short-term interest rates are at the time.

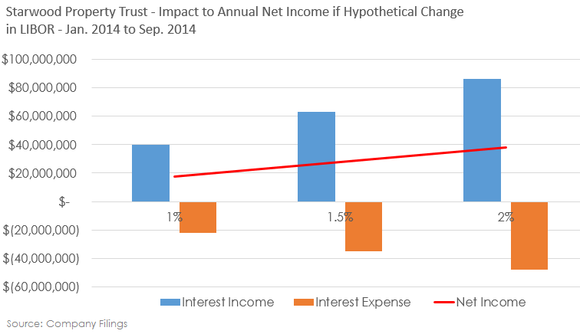

The chart above is the smoking gun. It answers the question: If short-term interest rates increase -- specifically the LIBOR benchmark which is influenced by the Federal Reserve -- 1%, 1.5%, or 2%, what would happen to Starwood Property's annual net income?

Looking at the far left of the chart, if short-term rates increase by 1% the company would make an extra $39.9 million (blue), but because its borrowing costs would increase they would pay an extra $22.4 million in expenses (orange). Take the difference between the two and if rates increased 1% Starwood Property would earn a $17.5 million benefit (red line).

The same principles apply if short-term rates were to increase 2%, 3%, 4% and so on. The higher short-term rates go, the bigger Starwood Property's benefit.

Here's the best part Since Starwood Property has an advantage if the Federal Reserve increase rates, it makes sense to assume that if rates fall or stay where they are today the company would underperform. This could not be further from the truth.

As a specialty lender, Starwood Property makes short-term loans -- three to five years in length on average -- for things like building construction or property improvements. Because these loans rollover quickly the company can constantly update their portfolio to best suit the current and upcoming environment.

For instance, if interest rates rates were likely to fall, Starwood Property could align its portfolio with fixed-rate securities. In this case, because the interest rate on the loans would be locked in, falling interest rates would not hurt it at all. In fact, this is exactly what Starwood did in 2010 as 74% of the company's loan portfolio had fixed-rates -- this is compared to just 22% today.

Ultimately, as long as there is demand for Starwood Property's loan products -- which will be somewhat cyclical over time -- the company's flexibility to perform despite interest rates makes the company more versatile than many of its traditional mREIT peers and a great buy today.

How one Seattle couple secured a $60K Social Security bonus -- and you can too

A Seattle couple recently discovered some little-known Social Security secrets that can boost many retirees income by as much as $60,000. They were shocked by how easy it was to actually take advantage of these loopholes. And although it may seem too good to be true, it's 100% real. In fact, one MarketWatch reporter argues that if more Americans used them, the government would have to shell out an extra $10 billion every year! So once you learn how to take advantage of these loopholes, you could retire confidently with the peace of mind were all after, even if youre woefully unprepared. Simply click here to receive your free copy of our new report that details how you can take advantage of these strategies.

Source Url: http://www.fool.com/investing/dividends-income/2015/01/11/1-high-yield-dividend-stock-for-rising-interest-ra.aspx

A Seattle couple recently discovered some little-known Social Security secrets that can boost many retirees income by as much as $60,000. They were shocked by how easy it was to actually take advantage of these loopholes. And although it may seem too good to be true, it's 100% real. In fact, one MarketWatch reporter argues that if more Americans used them, the government would have to shell out an extra $10 billion every year! So once you learn how to take advantage of these loopholes, you could retire confidently with the peace of mind were all after, even if youre woefully unprepared. Simply click here to receive your free copy of our new report that details how you can take advantage of these strategies.

Source Url: http://www.fool.com/investing/dividends-income/2015/01/11/1-high-yield-dividend-stock-for-rising-interest-ra.aspx