Wondering if it’s a good idea to invest in gold this festive season? Don’t let the falling prices stop you

The last few years have been harrowing for gold investors, with international prices of the metal declining from $1,921 per troy ounce to about $1,240 now. But hold on, don’t write off gold yet. Global supplies of the yellow metal are likely to shrink as new reserves become increasingly difficult to find. And given that the Asian appetite for gold is set to grow, gold demand may only go up. Here are five reasons why you should buy gold now:

Limited reserves

In the years ahead, it is likely to get increasingly difficult for producers to find easy-to-mine deposits of gold. At 2,968.5 tonnes (Thomson Reuters GFMS data), many investors believe that 2013 may be the peak year for gold production.

Natural Resource Holdings, a firm which develops natural resource assets, says that in terms of reserves and resources, only 3.72 billion ounces of gold is available to producers. Of this, about 1.82 billion ounces (or 56,674 tonnes) may be recoverable. So even if only 1,100-1,200 tonnes of gold is mined every year, the identified resources will be exhausted in 50 years’ time. However, even if miners only prospect where reserves have been identified, they may not continue to get as much gold for every tonne of ore. The undeveloped mines are also said to have lower grade gold ore (0.89g/tonne) than the current producing mines (1.18 g/tonne).

In the last decade, gold mine production has increased at an annualised rate of only 2 per cent. There have been no new discoveries of gold deposits in the last four years thereafter; there were six in 2010 and one in 2011. Also, as miners dig deeper, they end up with only lower grade ore. The average grade of ore at producing mines has dropped from 5 g/tonne in the 1990s to about 1.8 g/tonne now, according to data from InteirraRMG, a company that provides global mining information.

Unviable

If gold prices decline any further, it will make production unviable. The average cost of producing an ounce of gold is said to be about $1,100. But some manage it at about $950-$1,000/ounce due to favourable geographical conditions at the pit and with the use of better technology and less labour. Now, with the current market price of gold at about $1,200/ounce, many miners, especially the junior and mid-tier ones, have shelved their plans to explore new deposits. This can reduce supply in the future. Experts say miners could have hedged their positions by selling gold futures when gold was selling above $1,500/ounce in 2011, but not many did. The few who did hedge sold only 30-40 per cent of their production.

Rising demand

Even today, more than 50 per cent of gold is consumed for jewellery. In the last decade, an average of about 2,000 tonnes of gold has been consumed every year as jewellery. In India and China, where gold is an essential part of festivals and weddings, people love to adorn themselves in gold and save it for their children. Their appetite for gold may only grow as their disposable incomes go up in future. Gold consumption demand hit an all-time high of 2,209.5 tonnes in 2013, with India and China alone consuming more than 1,200 tonnes as jewellery.

However, it is investment demand that is driving the demand for gold. Demand for gold bars and coins has risen from about 350 tonnes in 2004 to 1,654 tonnes last year.

This sharp increase follows opening up of the private gold investment market in China. As the People’s Bank of China lifted curbs on gold investment in 2004 and banks began to sell gold bars and market gold accumulation plans, the demand for gold bullion in the country increased phenomenally, with household savings getting channelled into gold. In 2013, the country consumed about 397 tonnes of gold (of the total consumption of 1,065.7 tonnes) in the form of bars and coins.

What’s interesting is that China’s central bank has also been silently amassing gold.

Since a large portion of China’s reserves are parked in US treasury securities, the country has reportedly bought gold in the last few years to de-risk its portfolio. Of China’s forex reserves of $3.82 trillion toward end-2013, $1.3 trillion was in US securities. If China’s central bank continues to diversify its reserves, it will provide ample support to gold prices.

Other central banks too are following a similar strategy to reduce the proportion of their forex reserves in dollar and euro-denominated securities and are turning to gold. Central banks that were net sellers of gold in the market till 2009, have been net buyers in the market from 2010.

Numbers compiled by WGC show that in 2013, the central banks bought 369 tonnes of gold as the metal slid to its multi-year lows in the year — even as investors (or is it speculators?) dumped gold in the West. Central banks of Russia, Kazakhstan, Azerbaijan and Korea have been among the major buyers.

Traders can reverse positions

It is no secret that the drop in gold prices was driven by speculators and their naked shorts. The short positions in Comex gold futures this year crossed 100,000 on September 23 and by October 7 increased to 107,628, according to CFTC (Commodity Futures Trading Commission) data. This is sharply higher over the previous eight-week average of 63,700. The last time short positions were more than 100,000 was in December 2013. Prices hit a low $1,182 then. But speculators, as we know, take short-term bets. When sentiments change, they immediately jump to the opposite camp. With the Federal Reserve turning more dovish recently — voicing concerns about global economic growth and the strengthening dollar — the pessimism on gold should wane. With prices having bounced from $1,183, the previous low being $1,182 in December 2013, it is already proof that fundamentals are supporting prices.

Retail investors, in fact, have started to buy. In September, the US mint’s gold coin sales rose to 58,000 ounces from 25,000 ounces in August.

Gold exchange-traded funds such as the US SPDR Gold Trust, however, continue to see outflows. In SPDR Gold Trust too, it is only the big fish that are playing and not retail people. Physical redemption is allowed only in bunches of 100,000 shares (or 10,000 ounces of gold). So, it is not common people, but large investors with speculative interest who trade in this ETF.

ETFs at NAV price

Gold ETFs in India, which were trading at a premium of 7-8 per cent to NAV last December due to supply shortages, have seen the premium fizz evaporate. This is thanks to the Government allowing more agencies to import gold, resulting in improved supply. Goldman Sachs' gold ETF — GoldBeES — the largest gold-backed exchange-traded fund in India, trades at ₹2,539 now and the NAV is ₹2,530.

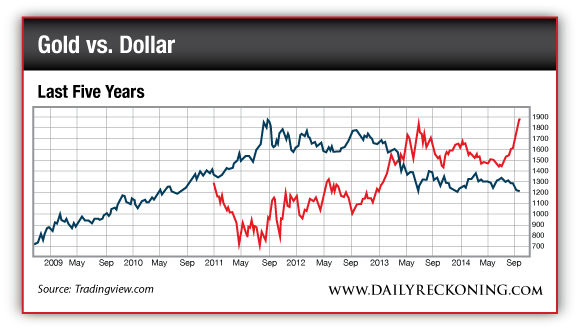

One factor that may perhaps impact gold prices negatively is the strength in the dollar. But it is not necessary for gold to always correct when the dollar strengthens.

An analysis of the movement of gold prices and the US dollar index over the last 30 years shows that dollar and gold prices have moved in the same direction in many years. In 2005, the US dollar index moved from 83.5 to 91.17 while gold moved from $423 to $517. This was similar to the behaviour witnessed in 1982 (108-125 vs. $387 to $423) and in the second half of 1980.

If you are not a short-term trader, you have nothing to worry now; you can just go ahead and buy gold. Prices can’t stay close to or below the cost of production for a long time.

You can consider parking 10-15 per cent of your portfolio in gold as a diversifier. In fact, it could be the right time for investors to start an SIP in gold ETFs. With the rupee likely to stay flat or weaken a bit more, investors may get to make some currency-related gains too.

Source url : http://www.thehindubusinessline.com/features/investment-world/five-reasons-to-buy-gold-now/article6516884.ece

CUPERTINO, Calif. - October 21, 2014 (www.investorideas.com newswire)

Apple® (AAPL) announced financial results for its fiscal 2014 fourth

quarter ended September 27, 2014. The Company posted quarterly revenue

of $42.1 billion and quarterly net profit of $8.5 billion, or $1.42 per

diluted share. These results compare to revenue of $37.5 billion and net

profit of $7.5 billion, or $1.18 per diluted share, in the year-ago

quarter. Gross margin was 38 percent compared to 37 percent in the

year-ago quarter. International sales accounted for 60 percent of the

quarter's revenue.

CUPERTINO, Calif. - October 21, 2014 (www.investorideas.com newswire)

Apple® (AAPL) announced financial results for its fiscal 2014 fourth

quarter ended September 27, 2014. The Company posted quarterly revenue

of $42.1 billion and quarterly net profit of $8.5 billion, or $1.42 per

diluted share. These results compare to revenue of $37.5 billion and net

profit of $7.5 billion, or $1.18 per diluted share, in the year-ago

quarter. Gross margin was 38 percent compared to 37 percent in the

year-ago quarter. International sales accounted for 60 percent of the

quarter's revenue. "Our fiscal 2014 was one for the record books, including the

biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus," said Tim

Cook, Apple's CEO. "With amazing innovations in our new iPhones, iPads

and Macs, as well as iOS 8 and OS X Yosemite, we are heading into the

holidays with Apple's strongest product lineup ever. We are also

incredibly excited about Apple Watch and other great products and

services in the pipeline for 2015."

"Our fiscal 2014 was one for the record books, including the

biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus," said Tim

Cook, Apple's CEO. "With amazing innovations in our new iPhones, iPads

and Macs, as well as iOS 8 and OS X Yosemite, we are heading into the

holidays with Apple's strongest product lineup ever. We are also

incredibly excited about Apple Watch and other great products and

services in the pipeline for 2015."